osceola county property tax payment

Policefire hospitals parks transportation and watersewage treatment plants receive similar fiscal support. If you are an existing account user this access code will be.

Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes.

. If you dont pay by the due date you will be charged a penalty and interest. The School District of Osceola County FL 2021-2022 Payroll Schedules Superintendent Dr. 407 742-4000 407 742Fax.

Create a free account and review your selected propertys tax rates value assessments and more. This deferment allows you time to pay your winter taxes between March 1 - April 30 without penalty or interest in anticipation of receiving a homestead property tax refund. Osceola Real Estate Personal Property Tax Information.

Box 422105 Kissimmee FL 34742-2105. Live Chat Available Mon-Fri 800AM-600PM Call 407-742-2900 to reach our IT Department. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523.

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. A major portion of property tax revenues goes toward district schools. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. The following payment schedule applies to the installment plan. Welcome to the Tax Online Payment Service.

Osceola County Tax Collector. The Mississippi County Treasurer and Tax Collectors Office is part of the Mississippi County Finance Department that encompasses all. Osceola Tax Collector Website.

Welcome to the Osceola County Property Appraisers on-line Tangible Personal Property Tax Return filing system. Internal Revenue Service IRS Wisconsin Department of Revenue. If the estimated tax is greater than 10000 tangible personal property taxes may be paid quarterly.

Search all services we offer. Payment will be made on RUN 031 Check Date July 14 2022. The Mississippi County Tax Collector located in Osceola Arkansas is responsible for financial transactions including issuing Mississippi County tax bills collecting personal and real property tax payments.

BSA Software provides BSA Online as a way for municipalities to display information online and is not. Payment due by June 30th. We have implemented a sign in procedure that requires a predetermined static access code.

In-depth Osceola County FL Property Tax Information Assess all the factors that determine a propertys taxes with a detailed report like the sample below. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. Property taxes are due on September 1.

Payment of first half of real estate taxes is payable to the Village of Osceola by January 31st of each year. Visit their website for more information. Put another way if you live in Osceola County you can expect to pay 1210 for every 1000 of real estate value or 121.

14 the total estimated taxes discounted 45. Federal Tax Forms Publications. This service allows you to make a tax bill payment for a specific property within your Municipality.

Payment due by September 30th. Again real estate taxes are the largest way Osceola pays for them including more than half of all district school financing. Compared to the state average of 121 homeowners pay an average of 000 more.

Irlo Bronson Memorial Hwy. Osceola County videos are hosted through Vimeo. What is the due date for paying property taxes in Osceola county.

Out of the 67 counties in Florida Osceola County has the 5th highest property tax rate. Debra Pace Chief Financial Officer Sarah Graber Director. If Osceola County property taxes are too high for your revenue resulting in delinquent property tax payments you can take a quick property tax loan from lenders in Osceola County FL to save your property from a looming foreclosure.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Taxes become delinquent on April 1st each year at which time a 15 percent fee per month is added to the bill. Exemption for Combat-Wounded Disabled Vets.

Overview of Osceola County FL Property Taxes. You may now prepare and file your 2022 Tangible Personal Property Tax Return Online using TPP E-File. As part of our commitment to provide citizens with efficient convenient service the Village has partnered with Official Payment Corporation to offer payment of the first half of your real estate taxes over the internet or by telephone by calling 1-800-272-9829.

All other service categories eg. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241.

14 the total of estimate taxes discounted 6. The Tax Collectors Office provides the following services. To begin please enter the appropriate information in one of the searches below.

You can report a playback problem to the Osceola County IT Department using one of the methods below. This exemption provides an additional discount from the amount of property taxes on the homestead of a partially or totally permanently disabled veteran age 65 or older as of January 1 whose disability was combat-related.

Property Tax Search Taxsys Osceola County Tax Collector

Osceola County Property Appraiser Open Data

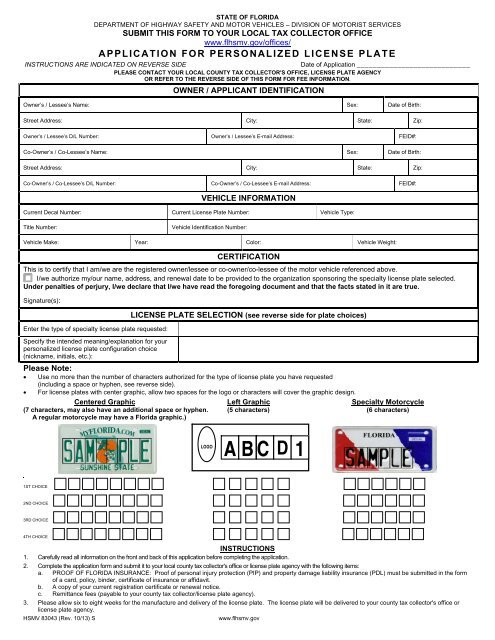

Application For Personalized License Plate Osceola County Tax

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola County Property Appraiser 2505 E Irlo Bronson Memorial Hwy Kissimmee Fl 34744 Usa

Job Opportunities Sorted By Job Title Ascending Osceola County Job Center

The School District Of Osceola County Florida

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Florida Wikiwand

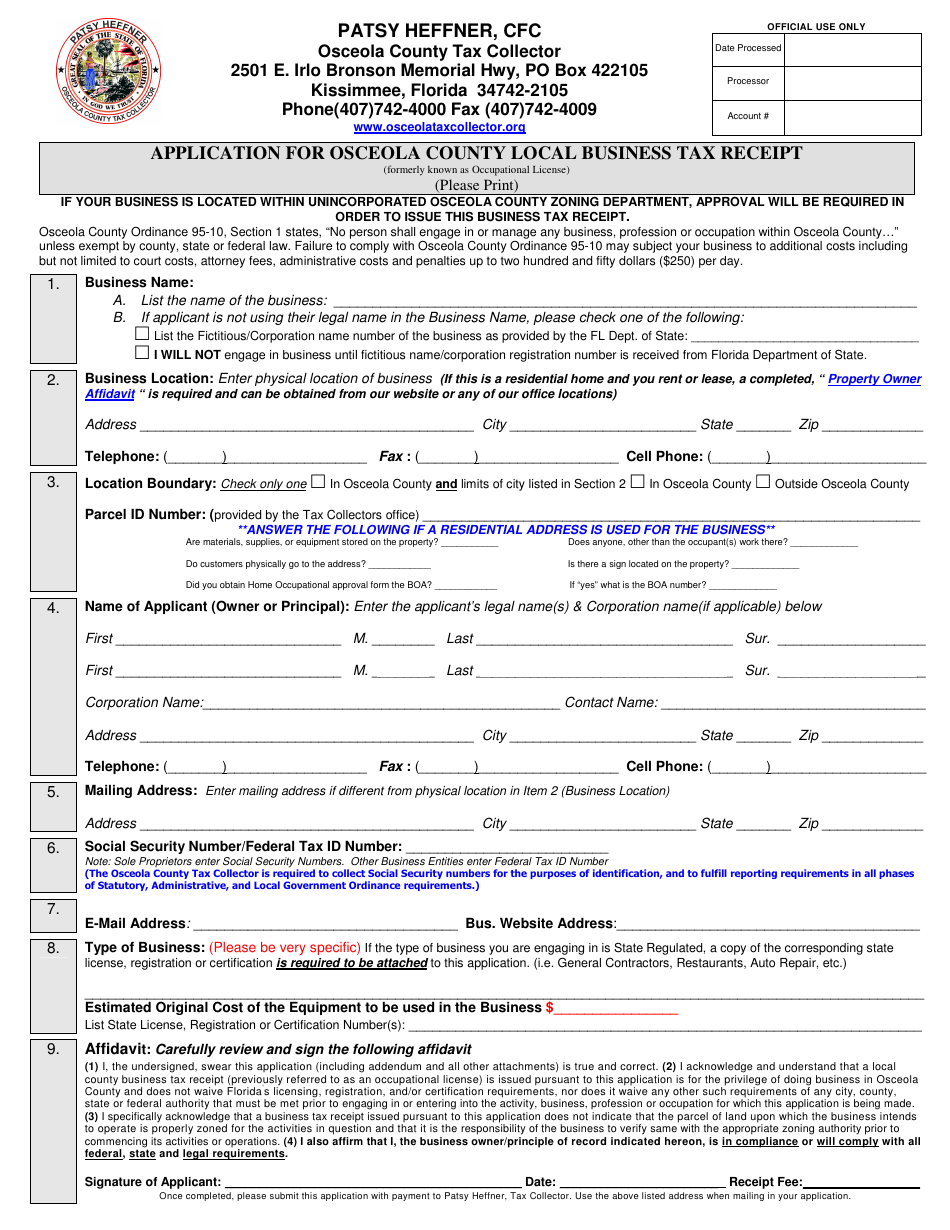

Osceola County Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Property Search Osceola County Property Appraiser

Osceola County Property Appraiser How To Check Your Property S Value

St Cloud Chamber Of Commerce Homestead Exemption Press Release Osceola County Property Appraiser Exemptions And Covid 19 Kissimmee Florida February 18 2021 Osceola County Property Appraiser Katrina Scarborough Encourages Osceola County

Application For Personalized License Plate Osceola County Tax